My first three posts revealed the three most important things I can tell any lawyer (or client) about insurance. Stated in the form of Universal Rules, they are:

- Rule Number One: The Insurance Company is Not Your Friend.

- Rule Number Two: Your Insurance Policy is a Contract.

- Rule Number Three: Filing a Claim Starts an Adversarial Process.

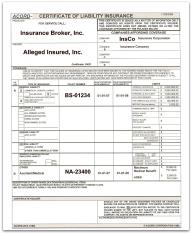

The remainder of this Insurance Landmines Series will disclose specific landmines that you and your clients may encounter, starting with the so-called “Certificate of Insurance.”

First, as you probably know, many contracts—construction contracts, service agreements, leases, loans, and so forth—require the junior party (the one with less leverage) to purchase insurance to cover risks arising out of the contract. Typically, the contracts require the junior party to have the senior party (the one with more leverage) listed on the policy as an additional insured. And in most cases they require the junior party to provide a Certificate of Insurance to prove that the right kind of coverage has been purchased and that the superior party has been listed on the policy as an additional insured.

But a Certificate of Insurance by itself is meaningless.

It’s not really a certificate at all, at least not in the usual sense. It does not prove that an insurance policy has been purchased, or that any policy listed on the certificate provides the desired coverage, or that it provides coverage for the senior (or junior) party. A Certificate of Insurance does not require an insurance company to provide coverage for anyone or anything. In most cases, the certificate will have been issued by a broker, not the insurer, and the insurer will not even know of its existence. In some cases, it will have been issued by the policyholder itself through the broker’s website, perhaps at the unsupervised discretion of an untrained clerk or secretary.

Over the past 26 years, I have been called into countless cases where a Certificate of Insurance had been issued but the coverage itself had not been purchased, or the coverage was purchased for the wrong person or entity, or the coverage was for the wrong location and time-frame, or it was largely nullified due to exclusions, or it was the wrong kind of coverage altogether.

In most of those cases the insurer took the position, at least initially, that there was no coverage for the disaster at hand and that the insured should “talk to his broker.”

In most of those cases the insurer took the position, at least initially, that there was no coverage for the disaster at hand and that the insured should “talk to his broker.”

The best way—and probably the only way—to avoid Certificate of Insurance landmines is to get a complete copy of the actual policy and read it to be sure it provides the required coverage. If the policy has not been issued yet, as is sometimes the case, it should still be possible to get a specimen of the proposed policy and study that. If that cannot be done, it may be necessary to temporarily accept a Certificate of Insurance until the policy becomes available, making sure that the certificate has been issued by the broker, not the policyholder, that and it is accompanied by an endorsement identifying by name or description the additional insured(s) required by the contract. This is a dangerous course, however, because diligent follow up is required to ensure that the desired coverage is eventually issued.

In short, do not rely on a Certificate of Insurance as proof of coverage. It isn’t. It's an Insurance Landmine.